Our Definitive Guide to Buying a Home – Part 1

We’ve noticed a lot of clients on the move recently, the housing market abuzz as the warmer weather arrives. This, along with Dave Ramsey’s recent pieces on home buying, made us think a series on buying a home appropriate for our next few blogs!

To start, we decided that there are four questions that every potential homebuyer must ask before diving into the home-buying process. Take a look and let us know what tips you have for buying a home! You may see your tip in part two!

1. Is your Savings and Credit in Order?

I know you want to jump into the home browsing and buying right away, but the fact of the matter is money comes first.

Ideally, you should be out of debt and have an emergency fund made before even thinking about buying a home.

Running credit reports are imperative too. Reports are kept by three major agencies:

- Experian

- Transunion

- Equfax

Get a copy of their reports to find your scores, because good credit can mean lower monthly payments, just like in insurance. Some clients advocate Fair Issac’s MyFICO.com for finding these reports.

Speaking of monthly payments…

2. What’s Affordable for You?

Your monthly payments on a home should never consume more than 30% of your take-home pay. This means taking the time to learn how much you can actually afford for your new home.

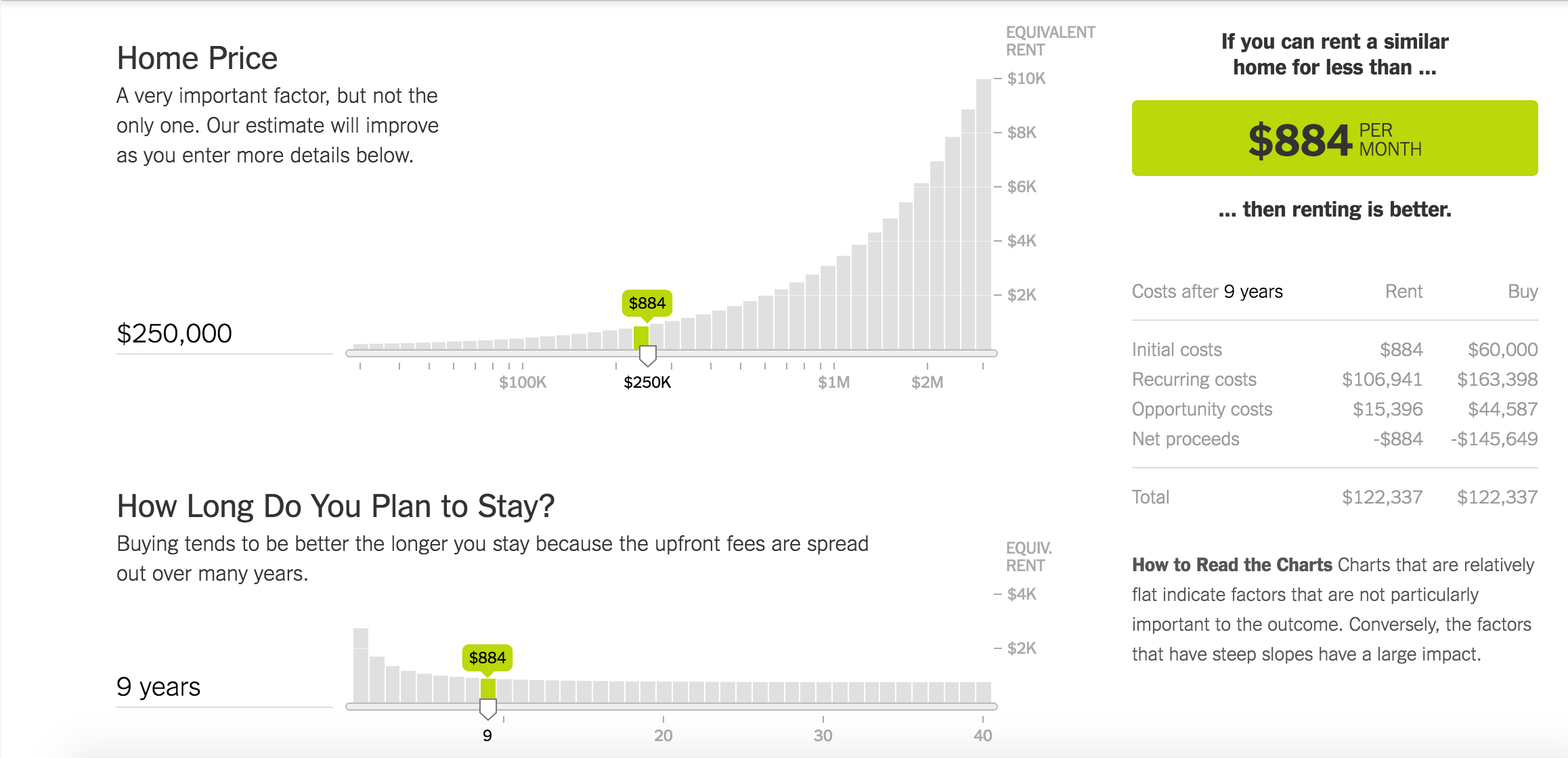

The easiest place to start here is with online calculators. New York Time’s has a great “rent or buy” calculator here!

Keep in mind that you should feel comfortable being in the same home for at least 10 years and that there will be long-term costs to account for like property taxes, insurance, maintenance fees, etc.

3. Have You Been Pre-Approved for a Mortgage?

Do not bother looking for a new home until you obtain pre-approval (not pre-qualify) for a mortgage!

You can obtain the pre-approval letter from a mortgage lender or bank, but do not let them bully you about your potential mortgage payment. If you are a couple looking to buy, you can even tell the lender that you want to afford the home on one income, just in case something happens to one of your jobs.

The idea is to aim for a home that costs less than the max amount for which you qualify.

4. Do You Have Your Agent?

A buyer’s agent has the knowledge, skills, and experienced needed for a quality home buying experience. Do not house-hunt without one!

Ensure you hire one exclusively for you and your search, instead of relying on the seller’s agent, who is only looking for a better deal on their end. You want the agent to align with your goals, so seek out recommendations from friends and “interview” a few over coffee first.

With their professional experience, your agent can potentially save you thousands on a home purchase because of their position to negotiate. Be sure to tell them everything about your home buying process including

- If you are able to buy in cash

- Have the pre-approval for a mortgage like we discussed

- If you don’t already own a home you would need to sell first

Similarly, having the right agent for your home insurance makes a huge difference in the cost of your policy. Stop by our office and see the difference! 1218 8th Ave, Greeley.

What tips do you have for buying a home? Let us know and check back next week for Part 2!

Categories: Blog